In parallel, hardware startups have had to build up an increasingly complex skill stack, such as branching out into data science, and it does not stop when going public like Fitbit and GoPro. A fully-fledged ecosystem is quickly becoming a necessity.

You might think this would deter new entrants. On the opposite, not only do hardware startups keep multiplying, but software firms are joining the dance. Here are five trends we’ve been seeing this year in hardware.

Trend #1: Software Startups Get Into Hardware

Several famous companies such as Kodak, Nokia, Blackberry, and Polaroid missed the turn to digital. But the new turn into smart hardware is not turning atoms into bits—it’s adding bits to atoms.

- Google entered the ‘full-stack’ scene with a bang last year, with Google Home and its Pixel phone. Those are showing the company’s ambition in owning it all and avoiding a potential disruption. Google now has stores and might have to become a worldwide distribution powerhouse in order to rival Apple.

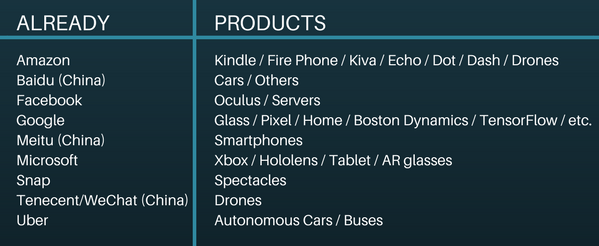

- Facebook and Microsoft have been investing massively in hardware for years: Oculus and server technologies for the former, Xbox, hololens, and tablet for the latter. Amazon has been active on several fronts in robotics (acquisition of Kiva’s warehouse robots, test of delivery drones) and consumer with the year of Alexa (will sales rival Kindle?).

- Uber went into autonomous cars and buses, and might add last-mile delivery drones like Dispatch to its A.I.-powered vehicle armada.

- Snap released its spectacles in a move which dates back to 2014 – hardly an afterthought.

Here is a quick summary of notable software companies getting into hardware:

So who’s next? All bets are off!

- Instagram might be eying on companies like Polaroid or Prynt as they think about their Q4 sales numbers.

- Adobe might be looking at new product acquisitions like Palette.

- Autodesk already invested in 3D printers and might add tools like Wazer, Glowforge or Voltera, becoming an end-to-end solution for prototype to production.

What about those in the “Next” category? Will Pandora or Spotify build their own speakers? Will Pinterest invest in augmented reality? Will Skype add volumetric display such as Looking Glass? Airbnb introduce smart home devices or robots?

Trend #2: Traditional Companies Turn To Hardware Acquisitions

Most recent acquisitions were more IP acquisitions or acqui-hires – like Nest or Oculus – than impacting the bottom line (like Beats or Dropcam).

Yet, three deals stood out:

- Dropcam: this was for sure a “product” acquisition. It added to the portfolio and contributed strongly to revenue. The culture clash with Nest’s Tony Fadell caused some controversy, which might have precipitated his departure.

- Whistle: the “fitbit for dogs”, acquired by Mars, the company behind Pedigree and Whiskas, but also Mars bars, Twix, and even Uncle Ben’s rice. Differing from the others, Whistle was likely acquired for data to understand the habits of pets, and likely sell more products to owners.

- Misfit: a good mix of a serious ‘bottom line’, technology and a large talented team was a perfect target for Fossil, which doesn’t want to end like dinosaurs.

Many connected hardware startups generate data. Despite efforts to look like a SaaS company, the vast majority is still searching for viable data-centric business models. It is already a steep learning curve to master manufacturing, supply chain, logistics, marketing, and distribution. Adding data science and finding a way to sell the insights is tough.

Interest is raising in all industries.

- Retailers have already started to invade the online space (Dick’s Sporting Goods acquired a mobile scorekeeping startup) and soon will want data on your preferences, habits, and performance.

- Beverage companies will want to know about your drinking preferences—the recent investment by Beam Suntory in Bartesian’s “Keurig for Cocktails” is a first step in that direction.

Soon, data will be the real gold and come from everywhere. The challenge will be who will own it, and mine it.

Trend #3: Hardware Goes Vertical

The hardware sector is fragmenting fast.

When we started HAX as the world’s first hardware accelerator back in 2011, we were mostly supporting startups creating consumer devices and “maker” products. Today, talking “hardware” and “IoT” is like talking about “website” or “app”: it doesn’t say much.

To reflect this, our accelerator program now has five definite “tracks”: Consumer Hardware, Health Tech Devices (from wellness to medtech), Enterprise (from service robots to agritech), and Industry (smart machines, advanced industrial robots, micro-factories).

Even “robotics” does not make much sense as a category: STEM robots like Makeblock and supermarket inventory robots like Simbe Robotics have little in common. t is time to focus on use cases, markets, and distribution channels.

Trend #4: Alexa and the Era of A.I.oT

Who would have guessed voice would be the killer app for consumer AI?

With Alexa, it is the second time, after the Kindle, that Amazon has proven a master at creating advanced technology for “normal people”. Alexa one-upped Siri.

A few contenders have appeared:

- Google Home

- Samsung with Viv (by the creators of Siri)

- Apple is next in line

Will Sony, Nintendo build something too?

All the way in China, Baidu is getting serious about A.I. – maybe Xiaomi will follow?

A.I. and Machine Learning (ML) are the new black and startups are multiplying. Compared to mobile phones, physical interfaces offer the key advantages of immediate access and narrow focus. They have one job and can do it at will. Once prices drop, we could imagine having a flurry of devices, each doing its own smart thing for us. In fact, it has already started: check Dashbot, the “Alexa for your car”, on Kickstarter for only $49!

After diverging, devices will likely converge again—with services following you from place to place, across devices, like diligent butlers. The era of “A.I.oT” (A.I. on Things) is coming. Now let’s hope we don’t confuse all their “wake-words”!

Trend #5: Breaking the Venture Mold

The pioneers of connected hardware are a just a few years old, but some, like Ring, Tile, Formlabs, Canary, and Makeblock are reaching meaningful revenue in the tens of millions.

For hardware startups, “users” mean revenue. And unless you made a bad mistake when pricing your product, revenue means profit on a per-unit basis. It’s a dramatic contrast with many software companies, who only have “users” to show, sometimes even past IPO time, leaving much uncertainty regarding their viability.

Still, many VCs are reluctant with hardware. That is probably what 20 years of software investment and chasing elusive unicorns does to you.

But industry players and public markets understand growth, revenue, and profit. In fact, it goes back to the roots of Silicon Valley with the likes of Intel. Fortunately, there are now attractive options for fast-growing “micro-caps”: smaller exchanges (Toronto, Hong Kong, etc.), RegA+ listings, reverse mergers, and more.

For consumer startups, this could mean that the time to turn their Kickstarter backers into true shareholders is coming soon.

Will this become a new way of sharing the wealth and Making Public Companies Great Again? Time will tell!

This piece appeared originally as a blog post on SOSV.com on June 7th 2017 and is re-posted with permission.